In the final section, we will conclude the article with some thoughts and considerations regarding credit card transactions on the Dark Web. Next, we will explore the payment methods used on the Dark Web and the measures individuals can take to protect themselves during transactions. Next, we will explore how to navigate the Dark Web and find reliable vendors to minimize these risks and protect against potential pitfalls.

Check For Exposed Customer Data

- Dark web scans work by crawling through hidden websites for instances of your personal information.

- The site’s operator also apparently contracted covid-19, according to a post on the site’s forum in October.

- The cards affected are mostly VISA, Mastercard and American Express cards.

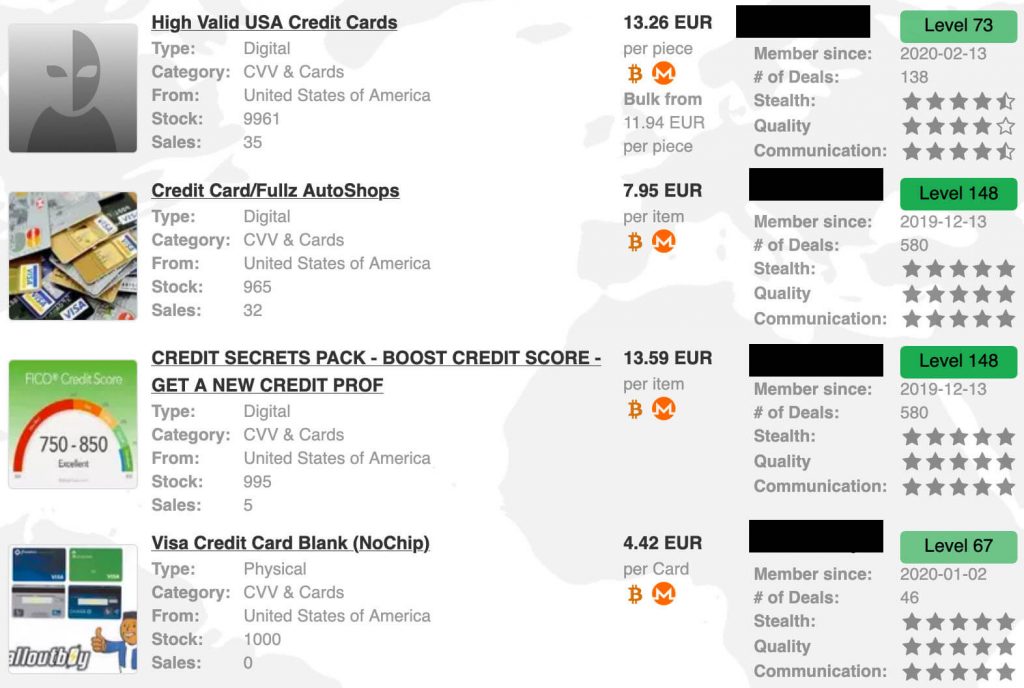

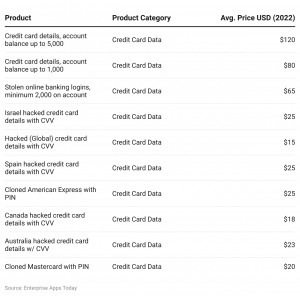

- For example, one seller offering US credit card numbers sold each one for between $10 – $12.

- Require multi-factor authentication for high-risk transactions, but it needs to be implemented intelligently.

This was followed by Monopoly Market, which became inaccessible early this month in what’s suspected to be an exit scam. Of the Italian cards, roughly 50% have already been blocked due to the issuing banks having detected fraudulent activity, which means that the actually usable entries in the leaked collection may be as low as 10%. The analysts claim these cards mainly come from web skimmers, which are malicious scripts injected into checkout pages of hacked e-commerce sites that steal submitted credit card and customer information. The “special event” offer was first spotted Friday by Italian security researchers at D3Lab, who monitors carding sites on the dark web.

Common Methods Used By Scammers To Steal Credit Card Data

– Remain cautious of vendors with no or limited feedback, as it becomes more challenging to assess their credibility and reliability. Information and Privacy Commissioner Angelene Falk urged all organisations to review their handling of personal information and data breach response plans. Dark web scans work by crawling through hidden websites for instances of your personal information. An Experian Dark Web Scan looks back to 2006 and searches through over 600,000 pages for your Social Security number, email or phone number. If your information is exposed, you’ll get insights on next steps to take to keep your identity safe. The most expensive card details, which cost about $20, were in Hong Kong and the Philippines and the cheapest, some at just $1, originated in Mexico, the US and Australia.

Password managers like Keeper are tools that not only aid in securing your online accounts, but also your most sensitive information – including your credit cards. Start a free 30-day trial of Keeper Password Manager today to start securing your most critical accounts and data from compromise. This article will explore credit card theft on the dark web, explain how criminals obtain and use stolen data, and explain how to detect and prevent credit card fraud. Card Shops typically host the trade of credit cards and other stolen financial information, making it easy for cybercriminals to find what they’re looking for. Dark web credit cards are often sold on online marketplaces, which can be accessed through specialized browsers like Tor.

Use encryption to protect customer data and secure your payment processing system. The more secure your information is, the less likely it will be to fall into the hands of a threat actor. Our platform alerts security teams when an organization’s sensitive data is found. Breachsense monitors the dark web, Telegram channels, hacker forums, and paste sites for external threats to your organization. By monitoring the dark web, you can quickly identify when your cards are compromised through partner organizations or merchants. Rather than individual hackers working alone, the reality is that we’re dealing with sophisticated criminal enterprises that function like businesses, complete with customer service and quality guarantees.

How Does My Data Get Onto The Dark Web?

Stolen credit card details can be categorized into different types, making it easier for cybercriminals to exploit them. Many tracker apps link directly to bank accounts for up-to-the-minute info. They show recent purchases, account balances, and spending trends all in one place. Wizardshop.cc was established in 2022, and offers a wide range of leaked CVVs, database dumps and even RDPs. In the past 6 months, the site has increased the volume of cards sold, placing itself as one of the top sites selling credit cards today.

- Banks and credit card companies lose billions annually to fraud, but the real cost isn’t just in fraudulent transactions.

- If the company you’re buying from doesn’t have your sensitive card information, neither will hackers that hit that merchant with a data breach.

- These details are needed for physical use such as withdrawing money from ATMs.

- Unless you live the rest of your life only paying with cash, you’ll never be totally impervious to payment fraud.

How Threat Actors Obtain And Trade Credit Card Data

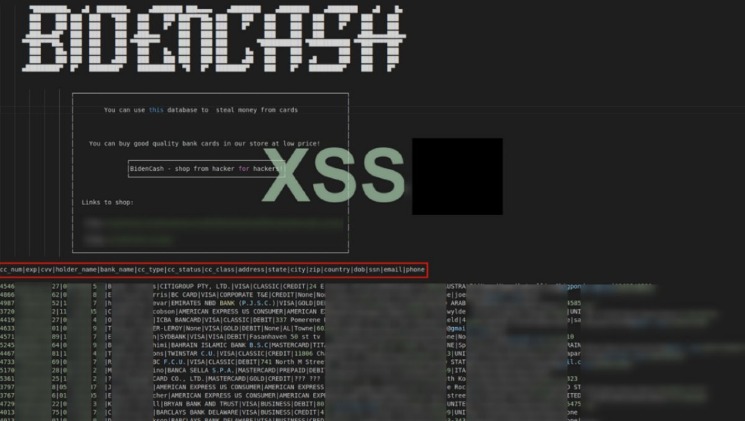

BidenCash shop was established in April 2022, following the seizure of other card shops and carding platforms by the Russian authorities. Since its inception, it has been attracting the attention of both old and new cybercriminal customers. In total, 57 percent of stolen financial records were related to Visa cards, followed by Mastercard at 29 percent. Looking at the actual numbers, we can identify the provinces with the most occurrences of credit card theft. First of all, of the credit card information we have collected, let’s find out which brand is the most prevalent.

The Security Validation Event Of The Year: The Picus BAS Summit

UniCC has been active since 2013 with tens of thousands of new stolen credit cards listed for sale on the market each day. Additionally, phishing scams and malware-infected websites are utilized to trick unsuspecting victims into providing their credit card details unknowingly. It is imperative for individuals to remain vigilant and exercise caution to protect their credit card information from falling into the wrong hands.

Dark Web Marketplace ‘BidenCash’ Hands Out 12 Million Stolen Credit Cards As A Promotion

Last year, another hacker credit card shop All World Cards released over 1 million card details online. An estimated 1 million U.S. and global credit cards were released by a Russian criminal organization on the so-called dark web, according to analysts at cybersecurity firm Q6. The group, which calls itself “All World Cards,” offers stolen credit card information to other criminals.

“By the time the data is in the underground, it’s gone through a number of stages to get there. So … how do we stop the data from ever being exposed or compromised in the first place, before it can be accessible by any criminals? … That’s’ where things like 3DS 2.0 and tokenization really come into play. So that if data is potentially compromised at an e-merchant site, for example, that data has no value if it’s compromised,” he explains.

It is important to note that engaging in such activities is illegal and unethical. The financial repercussions for victims can be debilitating, leading to damaged credit scores, fraudulent charges, and identity theft. Furthermore, participating in these illegal activities carries the constant risk of being caught by law enforcement agencies.

According to cybersecurity specialist Patricia Ruffio, the dark web market’s growth is due to notable changes in operations, including a new market leader and mimicking conventional marketing and retail operations methods. “These days, Dark Web sites compete on the quality of their security and customer service,” Ruffio states. “So, it’s no surprise that they now use traditional marketing tactics, too. Discounts (Buy 2 cloned credit cards, get one free), coupons, and product reviews are becoming common sights on the most competitive sites.” With this stolen information, fraudsters can make unauthorized purchases, withdraw funds, or even create counterfeit credit cards.

How To Protect Your Money From The Dark Web

It’s important to detect fraud when a threat actor is trying to use stolen payment information to make a purchase from your business. Tools like an Address Verification Service (AVS) can help detect fraud in online purchases by comparing a customer’s billing address with the address on file with the issuing bank. Flare’s Dark Web Monitoring platform monitors dozens of .onion sites for credit card fraud, BINS and other financial fraud related data.

The State Of DDoS Defenses: Unpacking A New Survey Of 300 CISOs & Security Directors

If the company you’re buying from doesn’t have your sensitive card information, neither will hackers that hit that merchant with a data breach. With stolen payment cards, a cybercriminal can immediately make purchases under your name, or even drain your bank account. And what’s worse, this shady corner of the internet is only getting bigger. The threat actor’s marketing strategy involves leaking a large number of credit cards to attract potential clients from hacking and cybercrime forums. This move is likely to increase the platform’s popularity and draw in new customers. Card checkers are tools used by threat actors to verify the validity and authenticity of credit card information they purchase on the dark web.